ComplyAdvantage has announced the launch of Mesh, a new AI-native platform designed to transform how financial institutions combat the escalating threat of financial crime.

The system unifies customer screening, transaction monitoring, and payments analysis within a single intelligent framework.

Financial crime has become an urgent global concern, threatening economic stability and national security. Governments and financial institutions face increasing pressure to preserve the integrity of the global financial system, yet less than 1% of an estimated $800bn–$2tn in illicit funds is ever recovered. The surge in AI-enabled financial crime—up 889% over the past two years—has rendered many traditional compliance tools obsolete, while false positives continue to drain resources, costing firms an estimated $100bn annually.

Founded to provide advanced financial crime prevention tools, ComplyAdvantage leverages proprietary data and AI to help organisations identify and manage risks linked to sanctions, politically exposed persons (PEPs), adverse media, and suspicious transactions. The company’s mission is to equip compliance teams with technology that turns regulatory obligations into opportunities for strategic growth.

Mesh represents a major step forward for the RegTech sector, being built entirely on AI foundations rather than retrofitted into legacy systems. The platform unifies screening, monitoring, customer risk scoring, and payments analysis, enabling compliance teams to maintain a single, consistent view of risk. This holistic approach is designed to reduce friction in both onboarding and transaction processes while delivering greater speed and accuracy in threat detection.

At the core of Mesh are three adaptive layers that function as one unified system. Its financial crime risk intelligence layer draws from real-time data sources, including sanctions lists and behavioural insights, aligned with global frameworks such as FinCEN, FATF, and the EU’s AMLD6. Its risk applications suite offers real-time screening and monitoring through configurable APIs, while agentic workflows powered by the AI teammate Cassie automate investigations, remediation, and filings—reducing false positives by 70% and cutting investigation times by up to 84%.

ComplyAdvantage CEO Vatsa Narasimha said, “Compliance teams are losing ground in an asymmetric battle. AI allows criminals to move faster and evade detection. But most institutions struggle to respond because of stale data, disparate systems, and team burnout because of false positive alerts. While legacy technology isolates teams and slows investigations, Mesh gives institutions the intelligence at their fingertips to tackle high-risk threats and turn compliance into a competitive advantage.”

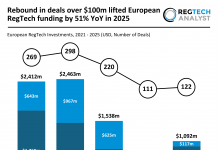

Keep up with all the latest RegTech news here

Copyright © 2025 RegTech Analyst

Copyright © 2018 RegTech Analyst