Home Tags EDD

Tag: EDD

How AI-driven AML compliance can help FIs in Malaysia

Malaysia’s financial sector is entering a critical transformation period as regulatory expectations tighten and financial crime threats evolve. Banks are operating under heightened pressure...

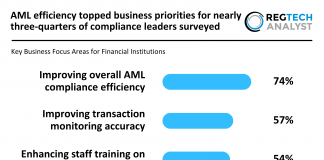

AML efficiency topped business priorities for nearly three-quarters of compliance leaders...

AML Trends 2025:

202 compliance professionals from 39 countries shared insights on their top AML goals and challenges

74% of compliance leaders prioritised improving...

Streamline compliance with one connected system

Financial institutions across the world continue to face severe regulatory consequences when compliance gaps arise.

A recent example comes from Oman, where the Financial...

Preventing organised crime in the TCSP sector

Organised crime groups have long seen trust and company service providers (TCSPs) as a convenient route to launder money and disguise illicit activity.

While...

The future of risk-based compliance in finance

The concept of risk-based approaches (RBAs) has become central to financial crime compliance worldwide.

According to Arctic Intelligence, unlike rigid, rule-based systems, RBAs allocate...

How AI Agent Edward is reshaping financial crime checks

WorkFusion recently unveiled AI Agent Edward, a solution designed to revolutionise enhanced due diligence (EDD) at financial institutions. The company, known for its AI...

Transforming due diligence with AI Agent Edward

WorkFusion, a pioneer in AI-powered automation for financial crime compliance, has introduced a groundbreaking innovation aimed at transforming enhanced due diligence (EDD) practices.

According to...

Napier AI’s call for smarter CDD practices in HM Treasury’s latest...

Napier AI has responded to a consultation from HM Treasury, the UK government's economic and finance ministry, on enhancing the effectiveness of the Money Laundering, Terrorist Financing, and Transfer of Funds (Information on the Payer) Regulations 2017 (MLRs). These regulations require businesses to identify and prevent money laundering and terrorist financing.

How AI transforms KYC into a continuous compliance powerhouse

In the dynamic landscape of anti-money laundering (AML) efforts, financial institutions are facing intensified scrutiny to stay a step ahead of increasingly sophisticated criminal tactics and rigorous regulatory demands.

Unlocking the secrets of enhanced due diligence in global finance

The world of global finance comes with its share of dangers. From the looming shadows of money laundering to the menace of terrorist financing,...