Financial crime prevention is undergoing a major shift as instant payments, rising transaction volumes and increasingly sophisticated criminal methods expose the limits of traditional compliance models.

Banks and financial institutions are now grappling with the pressure to either expand compliance teams to keep up with escalating alert volumes or risk missing critical risks hidden within complex transactional activity. The challenge has reached a tipping point, and the industry is searching for a more resilient and scalable solution.

SymphonyAI, which offers AI solutions for FinCrime, recently explored what the 50/50 compliance model is.

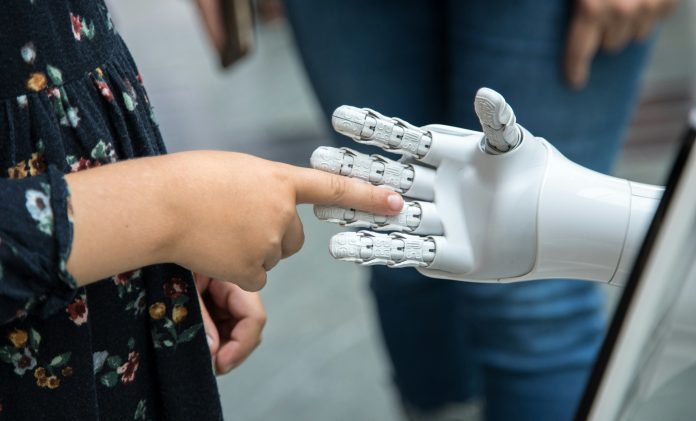

The emerging 50/50 Compliance Model is quickly becoming a blueprint for institutions looking to combine operational efficiency with regulatory assurance, it said. The model brings together advanced AI technologies and human expertise, using each where they add the most value. Rather than viewing automation and human oversight as opposing forces, the 50/50 approach integrates both to deliver stronger, faster and more consistent outcomes in risk detection and escalation.

Platforms such as SymphonyAI’s Sensa Risk Intelligence (SRI) are helping to enabling this balance. Using predictive, generative and agentic AI, these systems automate half of the compliance workload while enabling human investigators to focus on high-judgment decisions.

An overreliance on manual investigation has long been the default for compliance teams, but this model is slow, costly and increasingly unsuitable as transaction volumes grow. Conversely, calls for full automation overlook the essential judgement required in the most sensitive areas of compliance, such as determining whether to file a Suspicious Activity Report, block payments or offboard a customer. The 50/50 approach strikes the balance by allowing AI to handle scale while humans handle nuance.

Under this framework, half of all compliance activities are supported by AI, whether through anomaly detection, alert enrichment, workflow automation or scoring and prioritisation, it said. These capabilities dramatically reduce manual workload and allow investigators to begin each case with a complete and enriched set of information, enabling faster and more accurate decision-making. Predictive and agentic AI also play a major role in eliminating false positives, identifying patterns, and integrating regulatory updates into operational workflows in real time.

Human oversight remains indispensable. Investigators bring context, challenge AI-generated recommendations and adapt policies in response to new risks and regulatory requirements. While AI agents can streamline tasks and execute processes end-to-end, humans ensure the ethical, regulatory and operational integrity of every decision.

Sensa Risk Intelligence strengthens this balanced model by unifying operations across KYC, AML, sanctions, fraud and wider risk domains. With modular deployment options, organisations can layer AI capabilities onto existing systems before moving towards a more comprehensive technology stack. Its cloud-native architecture also removes the need for disruptive upgrades, ensuring teams maintain access to the latest capabilities without operational downtime.

Implementing the 50/50 model involves gradual transformation, SymphonyAI insisted. Institutions begin by identifying repetitive processes, applying AI overlays to improve detection, centralising casework in platforms like Sensa Investigation, and building agentic workflows to automate tasks under human supervision. The result is a compliance function that can scale efficiently, reduce costs and eliminate backlogs while increasing SAR conversion rates and reducing response times on high-risk cases.

By investing in technology that enhances human capability rather than replacing it, the 50/50 Compliance Model sets the foundation for a smarter, more strategic and more sustainable approach to financial crime defence.

For more, read the full story here.

Read the daily FinTech news

Copyright © 2025 FinTech Global

Copyright © 2018 RegTech Analyst