Home Tags Know your customer

Tag: know your customer

KYC Portal unveils new module for seamless identity checks

KYC Portal has unveiled its new Self Check-In module, enabling instant verification of individuals directly from within its back-office platform.

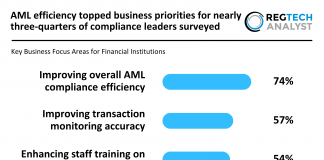

AML efficiency topped business priorities for nearly three-quarters of compliance leaders...

AML Trends 2025:

202 compliance professionals from 39 countries shared insights on their top AML goals and challenges

74% of compliance leaders prioritised improving...

Centralised CLM: the solution to KYC fragmentation

Know Your Customer (KYC) processes are the backbone of compliance across financial services, yet many organisations continue to rely on fragmented systems and disjointed processes.

Moody’s maps global sanctions landscape for 2025

Moody’s has released new research mapping the global landscape of sanctions regimes, offering insights into how governments and organisations deploy these measures and how...

Why AML customer screening is vital for compliance

Compliance remains one of the most pressing challenges for businesses in the financial services industry.

Striking the right balance between customer safety and seamless...

Identity verification vs authentication explained

When onboarding new clients, knowing who you're dealing with is essential—but how do you ensure your processes are both secure and compliant?

According to SmartSearch,...

Sanctions compliance strategies for asset managers

Asset management firms face increasing scrutiny when it comes to complying with global sanctions regulations. Failing to meet these obligations can result in severe...

KYC Portal CLM earns dual ISO certification for security and quality...

KYC Portal CLM has achieved ISO/IEC 27001:2022 and ISO 9001:2015 certifications—two globally recognised standards in information security and quality management.

Why banks are ditching right-sizing in favour of AI-driven AML/KYC compliance

WorkFusion has teamed up with 1LoD to produce a comprehensive Financial Crime Benchmarking Survey & Report, offering fresh insight into how top global banks...

How the 3 stages of money laundering work and how to...

When criminal organisations generate illegal profits, they must clean or ‘launder’ the money before it can be safely used in the legitimate economy. This is typically done through a carefully structured three-stage process. Understanding these stages is vital for businesses implementing anti-money laundering (AML) strategies, as it can help identify potential criminal activity.