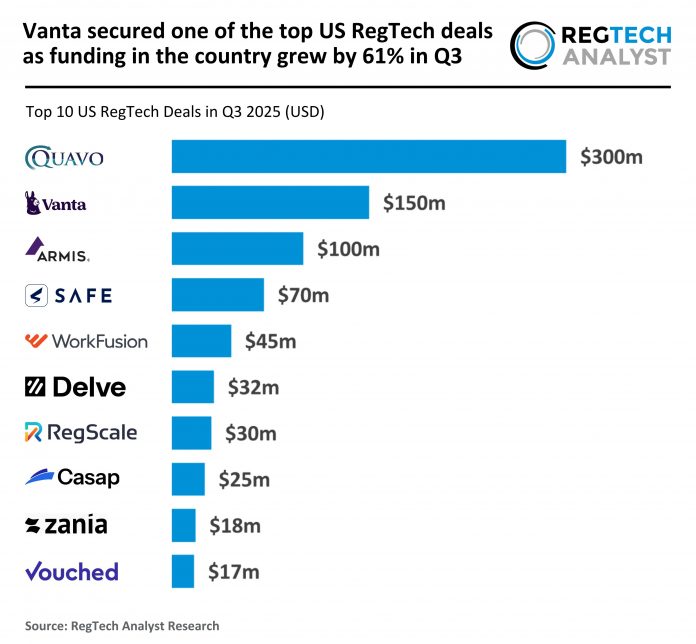

Key US RegTech investment stats in Q3 2025:

- US RegTech funding grew by 61% YoY in Q3

- Californian companies secured half of the top 10 deals to retain the state’s position as the main US RegTech hub in the quarter

- Vanta, a leading US-based RegTech specialising in AI-powered trust management, secured one of the biggest RegTech deals of the quarter with a $150m Series D funding round at a $4.15bn valuation

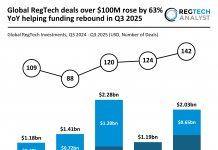

US RegTech funding grew by 61% YoY in Q3

In Q3 2025, the US RegTech sector saw a notable rebound, recording $1.4bn in total funding across 88 transactions — a 61% increase in investment value from the $848.2m raised in Q3 2024, alongside a 73% surge in deal volume from 51 deals.

This substantial growth in both capital inflow and transaction activity highlights renewed investor confidence in the RegTech space, likely fuelled by heightened demand for advanced compliance automation, data protection, and AI-driven risk management solutions.

The strong rise in deal count also suggests greater participation from early- and mid-stage startups, reflecting a more active and competitive funding landscape.

Californian companies secured half of the top 10 deals to retain the state’s position as the main US RegTech hub in the quarter

The top 10 deals in Q3 2025 were once again led by California, which retained its position as the sector’s primary hub with companies securing five top deals — mirroring its dominance in Q3 2024.

However, the composition of other states in the top tier shifted notably. New York re-emerged strongly with two top deals, while Washington, Virginia, and Delaware each contributed one.

In contrast, states such as Maryland, Florida, North Carolina, and Texas, which had featured in the Q3 2024 list, were absent this time.

This change underscores a geographical consolidation of major RegTech activity towards established innovation centres like California and New York, suggesting that investor focus is increasingly concentrated in states with strong regulatory and technology ecosystems.

Vanta, a leading RegTech specialising in AI-powered trust management, secured one of the top US RegTech deals of the quarter with a $150m Series D funding round at a $4.15bn valuation

The funding round was led by Wellington Management alongside existing backers including Goldman Sachs Alternatives, Sequoia, J.P. Morgan and Atlassian Ventures.

Founded in 2018, Vanta has evolved from helping startups automate SOC 2 compliance to offering a full-stack platform that enables over 12,000 companies across 58 countries to continuously monitor risk, manage compliance, and prove trust in real time.

Its technology integrates zero-touch verification, vendor risk management, access reviews and real-time Trust Centers, moving security from static checks to continuous, automated assurance.

AI innovations such as the Vanta AI Agent and Questionnaire Automation streamline evidence collection, accelerate security reviews, and cut response times by over half, saving teams up to 12 hours per week.

The new funding brings Vanta’s total capital raised to $504m since 2021 and will be used to expand AI-driven solutions in areas such as third-party risk and government compliance, reinforcing its position as a global leader in reshaping the governance, risk, and compliance (GRC) landscape.

Keep up with all the latest RegTech news here

Copyright © 2025 RegTech Analyst

Copyright © 2018 RegTech Analyst