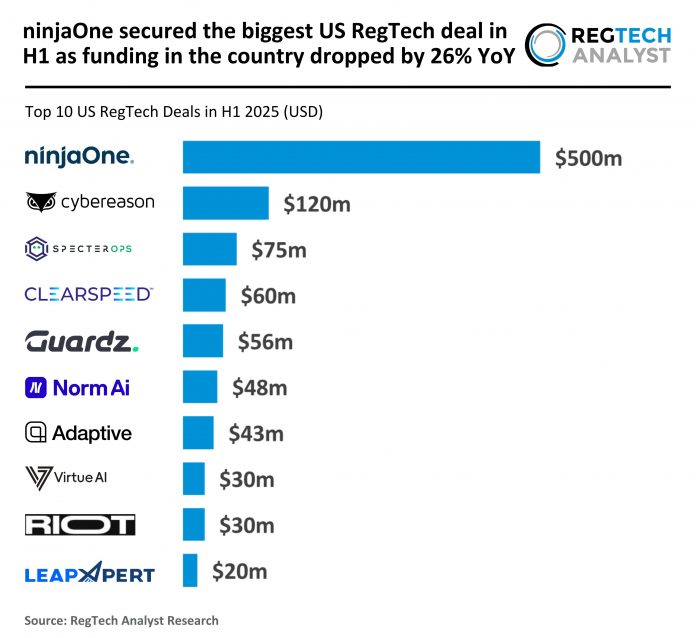

Key US RegTech investment stats in H1 2025:

- US RegTech funding dropped by 26% YoY in H1

- Californian companies secured 40% of the top 10 deals to dominate the US RegTech market

- Texas-based ninjaOne, a leading automated endpoint management platform, secured the biggest US RegTech deal of the first half of the year with a $500m Series C extension

US RegTech funding dropped by 26% YoY in H1

In H1 2025, the US RegTech sector recorded 123 transactions, representing a modest decline of 10% compared to the 137 deals completed in H1 2024.

Funding, however, experienced a sharper contraction, with total investment falling to $2.3bn, down 26% from the $3.1bn raised in the same period last year.

While deal activity has held relatively steady, the reduction in capital deployed points to investors becoming more cautious and selective, favouring fewer but potentially higher-quality opportunities.

This divergence suggests that while the pipeline of deals remains active, the appetite for larger ticket sizes has waned in the face of broader economic and funding pressures.

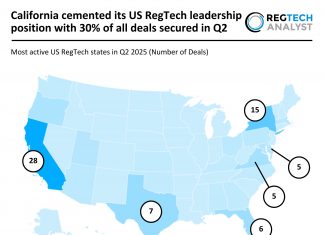

Californian companies secured 40% of the top 10 deals to dominate the US RegTech market

The top 10 deals in H1 2025 highlighted California’s continued dominance, with four major transactions, an increase from three in H1 2024.

New York also expanded its influence, securing three top deals compared with just one in the previous year.

Texas maintained its presence with a single top deal across both periods, underscoring its steady role in the sector.

New entrants Florida and Virginia made the 2025 list with one top deal each, reflecting a broader geographic spread of significant transactions.

In contrast, Washington, Massachusetts, and Ohio, which collectively accounted for four top deals in H1 2024, were absent from the H1 2025 rankings.

This shift underscores a rebalancing of deal flow towards the established hubs of California and New York, while also highlighting emerging activity in new state markets.

Texas-based ninjaOne, a leading automated endpoint management platform, secured the biggest US RegTech deal of the first half of the year with a $500m Series C extension

The funding round extension comes at a $5 bn valuation, led by ICONIQ Growth and CapitalG.

The funding will accelerate the company’s advancements in autonomous endpoint management, patching, and vulnerability remediation—key areas in regulatory compliance and cybersecurity risk management.

With more than 24,000 customers across 120+ countries, NinjaOne plays a critical role in helping businesses streamline endpoint security, ensuring compliance with evolving regulatory standards.

The investment will also support the company’s acquisition of SaaS backup and data protection leader Dropsuite, further strengthening its data compliance capabilities.

As regulatory scrutiny intensifies and cyber threats grow more sophisticated, NinjaOne’s AI-driven automation enhances security operations by reducing risk, improving visibility, and ensuring compliance at scale, making it a vital partner for enterprises navigating complex regulatory environments.

Keep up with all the latest RegTech news here

Copyright © 2025 RegTech Analyst

Copyright © 2018 RegTech Analyst