Key European RegTech investment stats in Q1 – Q3 2025:

- European RegTech funding grew by 9% YoY

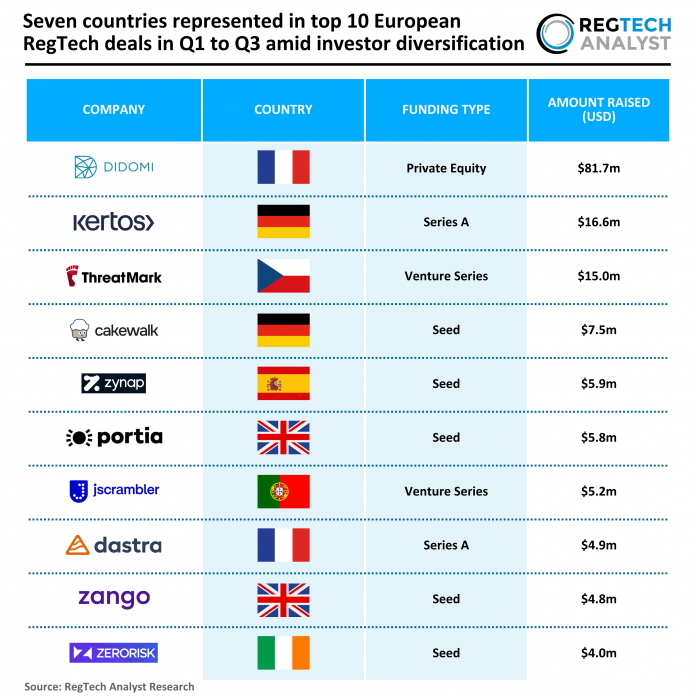

- European top 10 RegTech deals saw seven countries represented as investors diversified in the first three quarters

- ThreatMark, a Czech-based RegTech innovator specialising in behaviour-based fraud prevention, secured one of Europe’s largest RegTech deals of the quarter with a $15m funding round

European RegTech funding grew by 9% YoY

Across the first three quarters of 2025, the European RegTech sector raised $605.1m from 82 deals, showing a 9% increase in funding compared with the $553.8m secured during the same period in 2024.

Deal activity also saw a slight uplift, rising from 81 to 82 transactions.

Although the improvement in deal count was marginal, the rise in overall funding suggests a gradual strengthening in investor confidence, with larger-sized deals contributing to the upward trend.

This contrasts with the slight stagnation seen in the previous year and indicates a more resilient investment environment, even as broader market conditions remain mixed across the European technology landscape.

European top 10 RegTech deals saw seven countries represented as investors diversified

The top 10 deals during the first three quarters of 2025 displayed a more diversified geographical spread than in the equivalent period of 2024.

In 2025, France, Germany and the United Kingdom each secured two top deals, while the Czech Republic, Spain, Portugal and Ireland contributed one each.

By comparison, the 2024 list was more concentrated, with the UK capturing five top deals and France two, alongside single entries from Sweden, Denmark and Germany.

The shift from a heavily UK-led top-deal landscape to a more balanced distribution in 2025 indicates that high-value RegTech activity has broadened across the continent, with several emerging markets stepping into positions previously dominated by the region’s more established hubs.

ThreatMark, a Czech -based RegTech innovator specialising in behaviour-based fraud prevention, secured one of Europe’s largest RegTech deals of the quarter with a $15m funding round

The round comprised of participation from Octopus Ventures and Riverside Acceleration Capital.

The company leverages advanced AI and machine learning to protect financial institutions against sophisticated online fraud schemes, including authorised push payment scams, by continuously analysing behavioural, transactional, device, and threat data to detect anomalies in real time.

ThreatMark’s platform offers a scalable and accessible fraud detection solution that enables mid-market banks to operate with the same level of defence as global tier-one institutions.

With online banking fraud losses reaching $486bn globally in 2023, the company’s approach to adaptive fraud detection has seen growing adoption, underpinned by a 75% year-over-year ARR increase.

The new capital will accelerate product development, bolster its AI capabilities—including predictive analytics and threat modelling—and support expansion across the UK and US markets, further cementing its position as a leader in digital fraud intelligence.

Keep up with all the latest RegTech news here

Copyright © 2025 RegTech Analyst

Copyright © 2018 RegTech Analyst