Key global RegTech investment stats in Q3 2025:

- Global RegTech funding grew by 73% YoY in Q3

- US companies secured 90% of the top 10 deals to cement the country’s position as the leading RegTech hub globally

- Vanta, a leading RegTech specialising in AI-powered trust management, secured one of the top RegTech deals of the quarter with a $150m Series D funding round at a $4.15bn valuation

Global RegTech funding grew by 73% YoY in Q3

Global RegTech investment experienced a strong resurgence between Q3 2024 and Q3 2025, recovering significantly from previous market contractions.

In Q3 2024, the sector recorded 109 deals, raising a total of $1.2bn in investment. This pace accelerated remarkably in Q3 2025, which saw 142 transactions completed and total funding swell to $2bn.

This represents a substantial growth trajectory, with deal volume increasing by 30% and the total capital raised surging by 73% YoY.

The sharp jump in investment, nearly doubling the amount raised, suggests renewed investor confidence and a potential turning point for the RegTech market, shifting from a period of caution towards expansion and greater deployment of capital across the industry.

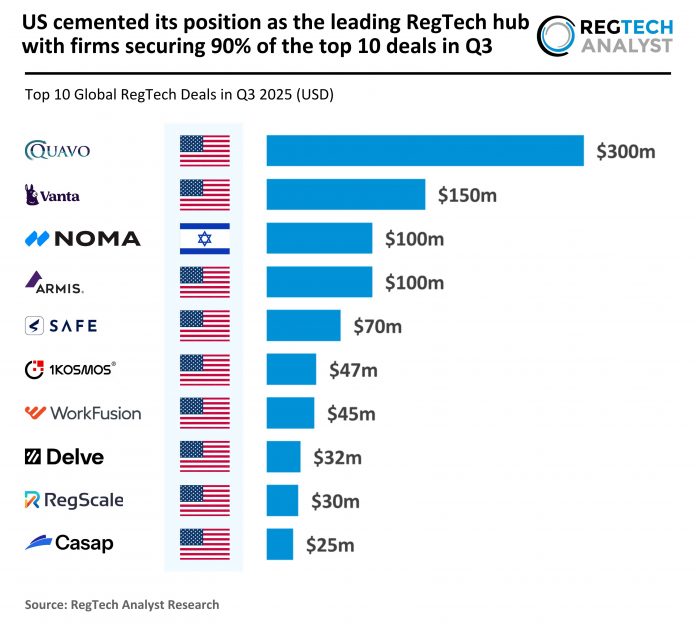

US companies secured 90% of the top 10 deals to cement the country’s position as the leading RegTech hub globally

The geographical distribution of the sector’s largest investments further emphasised the overwhelming market dominance of the US.

In Q3 2024, the US already commanded a leading position, securing six of the top 10 deals globally.

This domination became even more pronounced in Q3 2025, where the US secured a staggering nine out of the 10 largest deals, confirming its status as the leading global hub for high-value RegTech deal-making.

Key shifts were evident in the other major players; while the UK maintained a strong presence in Q3 2024 with three top deals, alongside France which secured one, both were absent from the Q3 2025 top ten list.

In contrast, Israel successfully entered the list in Q3 2025 with one top deal, highlighting emerging geographical dynamism despite the heavy concentration of capital in North America.

Vanta, a leading RegTech specialising in AI-powered trust management, secured one of the top RegTech deals of the quarter with a $150m Series D funding round at a $4.15bn valuation

The funding round was led by Wellington Management alongside existing backers including Goldman Sachs Alternatives, Sequoia, J.P. Morgan and Atlassian Ventures.

Founded in 2018, Vanta has evolved from helping startups automate SOC 2 compliance to offering a full-stack platform that enables over 12,000 companies across 58 countries to continuously monitor risk, manage compliance, and prove trust in real time.

Its technology integrates zero-touch verification, vendor risk management, access reviews and real-time Trust Centers, moving security from static checks to continuous, automated assurance.

AI innovations such as the Vanta AI Agent and Questionnaire Automation streamline evidence collection, accelerate security reviews, and cut response times by over half, saving teams up to 12 hours per week.

The new funding brings Vanta’s total capital raised to $504m since 2021 and will be used to expand AI-driven solutions in areas such as third-party risk and government compliance, reinforcing its position as a global leader in reshaping the governance, risk, and compliance (GRC) landscape.

Keep up with all the latest RegTech news here

Copyright © 2025 RegTech Analyst

Copyright © 2018 RegTech Analyst