AML Trends 2025:

- 202 compliance professionals from 39 countries shared insights on their top AML goals and challenges

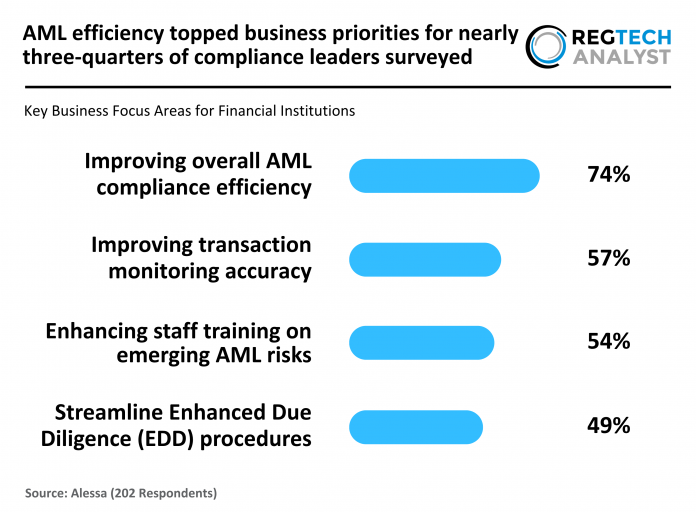

- 74% of compliance leaders prioritised improving overall AML compliance efficiency, signalling a strong push towards smarter, faster processes

- Nearly half aimed to streamline Enhanced Due Diligence (EDD), reflecting a broader drive to simplify and strengthen compliance operations

202 compliance professionals from 39 countries shared insights on their top AML goals and challenges

Alessa’s 2025 AML Trends Report by Alessa gathered insights from 202 compliance professionals across 39 countries, representing a diverse range of financial institutions and roles within the compliance ecosystem.

The survey captured the most pressing challenges and goals shaping AML strategies in the year ahead, from efficiency improvements to emerging technology adoption.

Designed to provide a global perspective, the report offers a valuable benchmark for how organisations plan to strengthen their defences against financial crime while navigating resource constraints and evolving regulations.

74% of compliance leaders prioritised improving overall AML compliance efficiency, signalling a strong push towards smarter, faster processes

The report revealed that 74% of compliance professionals identified improving overall compliance efficiency as their key priority for 2025.

This strong focus highlights the industry’s drive to enhance operational agility and reduce friction in AML processes. Improving transaction monitoring accuracy (57%) and enhancing staff training on emerging AML risks (54%) also ranked high on the agenda, reflecting an increased awareness of evolving threats such as cryptocurrency misuse and trade-based money laundering.

By investing in modernised frameworks and workforce upskilling, firms are positioning themselves to respond faster and more effectively to financial crime risks.

Nearly half aimed to streamline Enhanced Due Diligence (EDD), reflecting a broader drive to simplify and strengthen compliance operations

Nearly half of respondents (49%) stated that streamlining Enhanced Due Diligence (EDD) procedures would be a key focus area, underscoring the industry’s commitment to reducing complexity in high-risk client reviews.

This aligns with a broader ambition to use advanced technologies, such as automation and AI, to simplify compliance operations and strengthen accuracy.

Overall, the findings point to a proactive and forward-looking approach — where compliance teams are not only tackling inefficiencies but also laying the groundwork for a more resilient, tech-enabled AML landscape in 2025 and beyond.

Keep up with all the latest RegTech news here

Copyright © 2025 RegTech Analyst

Copyright © 2018 RegTech Analyst