AML Trends 2025:

- 172 financial crime professionals from across 7 APAC jurisdictions were surveyed

- 72% of respondents prioritised transaction monitoring to boost AML resilience

- Financial institutions are increasingly investing in technology to balance compliance and efficiency

172 financial crime professionals from across 7 APAC jurisdictions were surveyed

The Nice Actimize APAC AML Tech Barometer 2025 Report captured insights from 172 financial crime professionals across seven jurisdictions and five languages, reflecting a broad and inclusive regional perspective.

The study combined survey findings with in-depth interviews conducted in Singapore, Hong Kong, and Australia to provide a comprehensive understanding of financial institutions’ (FIs) priorities, challenges, and technological adoption in the fight against financial crime.

This multifaceted methodology allowed the report to highlight how regional players are approaching compliance transformation in an increasingly complex regulatory environment.

72% of financial experts surveyed identified prioritised transaction monitoring to boost AML resilience

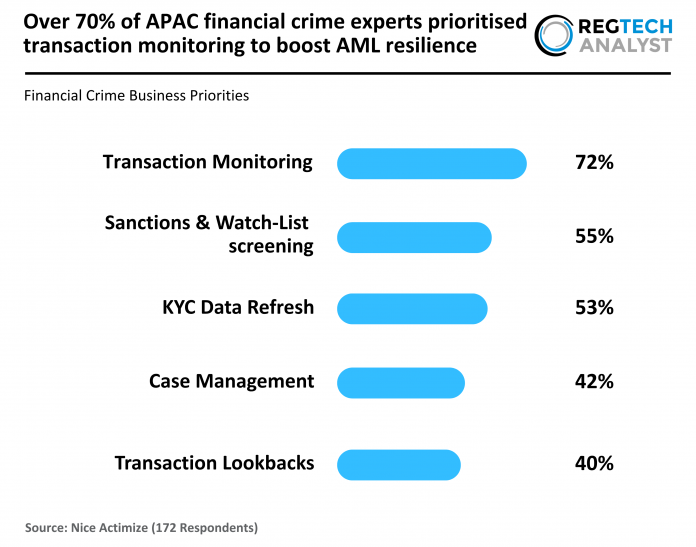

When asked about their financial crime business priorities for 2024–2025, a clear majority—72%—of respondents identified transaction monitoring as their key focus area, followed by sanctions and watch-list screening (55%) and KYC data refresh initiatives (53%).

Case management (41.5%) and transaction lookbacks (39.6%) were also highlighted as important, though secondary, areas of attention.

Recent research indicated that financial institutions across Asia are dedicating between $660m and $795m, or roughly 15% of their compliance budgets, to improving transaction monitoring and sanctions screening systems—underscoring a strong regional commitment to regulatory readiness and risk mitigation.

Financial institutions are increasingly investing in technology to balance compliance and efficiency

With rising regulatory scrutiny and operational demands, financial institutions across APAC are accelerating technology adoption to improve the accuracy and scalability of compliance operations.

Manual systems have struggled to keep pace with the complexity and volume of transactions, resulting in inefficiencies and high false-positive rates.

By investing strategically in dynamic, AI-powered solutions, firms are not only addressing these challenges but also positioning themselves for long-term success.

As one Singapore-based senior officer noted, “Balancing regulatory expectations and operational demands remains one of the toughest challenges in financial crime compliance—but with the right technology, the industry can turn compliance into a competitive advantage.”

Keep up with all the latest RegTech news here

Copyright © 2025 RegTech Analyst

Copyright © 2018 RegTech Analyst