Key Global RegTech investment stats in Q3 2025:

- Global RegTech deal activity grew by 35% YoY in Q3

- With nine deals secured, Canadian firms positioned the nation as an emerging powerhouse in the global RegTech landscape

- Vanta, a leading US-based RegTech specialising in AI-powered trust management, secured one of the biggest RegTech deals of the quarter with a $150m Series D funding round at a $4.15bn valuation

Global RegTech deal activity grew by 35% YoY in Q3

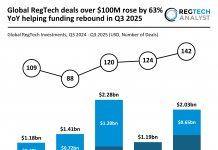

In Q3 2025, the Global RegTech industry recorded a strong rebound in funding and deal activity.

The sector raised $2.2bn across 201 deals, representing an 85% increase in funding compared with the $1.2bn raised in Q3 2024.

Deal volume also grew by 35%, up from 149 rounds in the same quarter last year, highlighting renewed investor confidence in the sector.

Compared with Q2 2025, funding nearly doubled, increasing by 83% from $1.2bn, while deal activity rose by 22% from 165 rounds, signalling accelerated momentum in both capital inflows and transactions.

With nine deals secured, Canadian firms positioned the nation as an emerging powerhouse in the global RegTech landscape

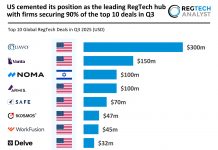

The US remained the clear leader in the RegTech market, completing 110 deals (55% share) in Q3 2025, a 67% increase from the 66 deals recorded in Q3 2024.

The UK followed with 11 deals (5% share), while Canada entered the top three with nine deals (4% share), replacing India, which had 10 deals (7% share) in the same quarter last year.

Despite the shift in ranking, the data shows the US further strengthened its dominance in global RegTech, while the UK and Canada maintained meaningful contributions to sector activity.

Vanta, a leading US-based RegTech specialising in AI-powered trust management, secured one of the biggest RegTech deals of the quarter with a $150m Series D funding round at a $4.15bn valuation

The funding round was led by Wellington Management alongside existing backers including Goldman Sachs Alternatives, Sequoia, J.P. Morgan and Atlassian Ventures.

Founded in 2018, Vanta has evolved from helping startups automate SOC 2 compliance to offering a full-stack platform that enables over 12,000 companies across 58 countries to continuously monitor risk, manage compliance, and prove trust in real time.

Its technology integrates zero-touch verification, vendor risk management, access reviews and real-time Trust Centers, moving security from static checks to continuous, automated assurance.

AI innovations such as the Vanta AI Agent and Questionnaire Automation streamline evidence collection, accelerate security reviews, and cut response times by over half, saving teams up to 12 hours per week.

The new funding brings Vanta’s total capital raised to $504m since 2021 and will be used to expand AI-driven solutions in areas such as third-party risk and government compliance, reinforcing its position as a global leader in reshaping the governance, risk, and compliance (GRC) landscape.

Keep up with all the latest RegTech news here

Copyright © 2025 RegTech Analyst

Copyright © 2018 RegTech Analyst