Key US RegTech investment stats in Q2 2025:

- US RegTech deal activity rose by 22% QoQ in Q2

- Californian companies secured 30% of all deals to solidify their position as US RegTech leaders

- Virtue AI, a California-based RegTech innovator focused on generative AI safety and compliance, secured $30m in one of the largest RegTech funding rounds in the US for Q2

US RegTech deal activity rose by 22% QoQ in Q2

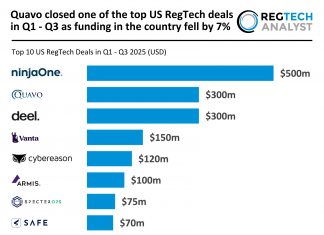

In Q2 2025, the US RegTech industry saw a significant decline in funding but an increase in deal activity compared to the previous year.

The sector completed 93 funding rounds, a 29% increase from the 72 deals recorded in Q2 2024.

However, funding fell sharply to $726m, a 56% decrease from the $1.6bn raised in the same quarter last year.

Compared with Q1 2025, the number of deals rose by 22% from 76, yet funding dropped by 54% from $1.6bn.

This divergence between deal activity and funding levels highlights a market shift towards a larger number of smaller transactions, signalling ongoing caution among investors.

Californian companies secured 30% of all deals to solidify their position as US RegTech leaders

California remained the most active RegTech state in Q2 2025, with 28 deals (30% share), a 40% increase from the 20 deals completed in Q2 2024.

New York followed with 15 deals (16% share), marking a 50% increase from 10 deals in the same period last year.

Texas completed seven deals (8% share), up 17% from six in Q2 2024.

Despite the downturn in overall funding, these leading states expanded their activity and share of total deal flow, underlining their continued dominance within the US RegTech ecosystem even amidst a weaker funding environment.

Virtue AI, a California-based RegTech innovator focused on generative AI safety and compliance, secured $30m in one of the largest RegTech funding rounds in the US for Q2

The round was co-led by Lightspeed Venture Partners and Walden Catalyst Ventures, with participation from high-profile investors including Prosperity7 and Osage University Partners.

Founded by leading AI researchers, Virtue AI delivers an enterprise-grade platform built to mitigate AI-specific risks such as hallucinations, prompt injections and data poisoning—threats often overlooked by traditional cybersecurity.

Its suite includes VirtueRed, a red-teaming solution assessing over 320 risk vectors; VirtueGuard, a real-time guardrails engine; and VirtueAgent, an automation tool for embedding compliance and safety into AI workflows.

As generative AI adoption surges across sectors, Virtue AI’s platform enables businesses to deploy advanced models safely and in line with regulatory standards.

This funding will be used to enhance platform capabilities, broaden go-to-market efforts and attract top AI talent, further establishing Virtue AI’s leadership at the intersection of AI and regulatory technology.

Keep up with all the latest RegTech news here

Copyright © 2025 RegTech Analyst

Copyright © 2018 RegTech Analyst